Investments, acquisitions and divestitures

In addition to innovations, investments and acquisitions make a decisive contribution toward achieving our ambitious growth goals. We are intensifying our investment in emerging markets and in North America. We use targeted acquisitions to supplement our organic growth.

€4,314 million

In investments made in 2016

€2,944 million

Used for acquisitions in 2016

Optimization

Of our portfolio through acquisitions and divestitures

By investing in our plants, we create the conditions for our desired growth while constantly improving the efficiency of our production processes. For the period from 2017 to 2021, we have planned capital expenditures1 totaling €19.0 billion. We want to invest more than a quarter of this amount in emerging markets and expand our local presence in order to benefit from the growth in these regions. In North America, investments in new production facilities form the basis of future growth. We also continue to develop our portfolio through acquisitions that promise above-average profitable growth, are driven by innovation, offer added value for our customers, and reduce the cyclicality of our earnings. Investments and acquisitions alike are prepared by interdisciplinary teams and assessed using diverse criteria. In this way, we ensure that economic, environmental and social concerns are included in strategic decision-making.

1 Excluding additions to property, plant and equipment from acquisitions, capitalized exploration, restoration obligations and IT investments

Investments and acquisitions 2016 (million €) |

||||||

|

|

Investments |

Acquisitions |

Total |

||

|---|---|---|---|---|---|---|

|

||||||

Intangible assets |

|

92 |

2,789 |

2,881 |

||

Thereof goodwill |

|

– |

1,552 |

1,552 |

||

Property, plant and equipment2 |

|

4,222 |

155 |

4,377 |

||

Total |

|

4,314 |

2,944 |

7,258 |

||

Investments

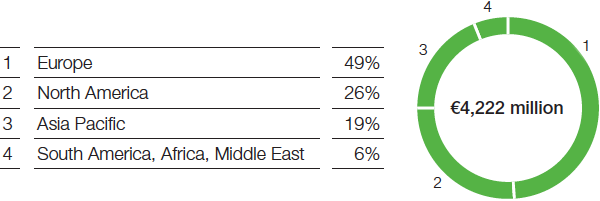

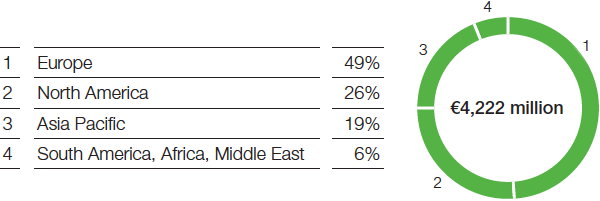

We invested €4,222 million in property, plant and equipment in 2016. Total investments were therefore €1,429 million lower than in the previous year and €531 million above the level of depreciation3 in 2016. Our investments in 2016 focused on the Chemicals, Performance Products and Oil & Gas segments.

In Ludwigshafen, Germany, we started up further sections of our integrated TDI complex in 2016. TDI production began in August 2016. In November 2016, the TDI plant was temporarily shut down due to a technical defect in one part. Repairwork was ongoing at the time of this report’s release. We continued work on revamping the new superabsorbent technology at the site in Antwerp, Belgium, and plan to complete this in 2017.

With our partner, PETRONAS Chemicals Group Berhad, headquartered in Kuala Lumpur, Malaysia, we completed construction on the new aroma ingredients complex at the integrated chemical site in Kuantan, Malaysia. Production facilities for citral and L-menthol will be gradually started up. In June 2016, we began construction of a new automotive coatings plant in Shanghai, China, together with our partner Shanghai Huayi Fine Chemical Co. Ltd., based in Shanghai, China. With these investments, we are expanding our presence in the emerging markets of Asia.

We are constructing an ammonia production plant in Freeport, Texas, together with Yara International ASA, headquartered in Oslo, Norway. At our site in Geismar, Louisiana, we completed the expansion of our butanediol capacities in 2016. The capacity expansion of our dicamba production in Beaumont, Texas, is expected to start up in 2017.

In the Oil & Gas segment, we invested primarily in field development projects in Argentina, Norway and Russia in 2016.

3 Including impairments and write-ups

Investments Chemicals

Investments Performance Products

Investments Functional Materials & Solutions

Investments Agricultural Solutions

Investments Oil & Gas

4 Including capitalized exploration, restoration obligationsand IT investments

Acquisitions

We gained €155 million worth of property, plant and equipment through acquisitions in 2016. Additions to intangible assets including goodwill amounted to €2,789 million.

On September 26, 2016, we completed the acquisition of Guangdong Yinfan Chemistry (“Yinfan”) in Jiangmen, China, and integrated the business into the Coatings division. This enabled us to add the Yinfan product line to our portfolio of automotive refinish coatings in Asia Pacific and gain access to a state-of-the-art production facility for automotive refinish coatings in China.

The purchase of global surface technology provider Chemetall from Albemarle Corp. in Charlotte, North Carolina, was completed on December 14, 2016. With the acquisition of this business, our Coatings division supplements its portfolio of tailor-made technology and system solutions for surface treatment. The purchase price amounted to $3.1 billion.

Effective January 1, 2017, we acquired the Henkel Group’s western European building material business for professional users, broadening the portfolio of our Construction Chemicals division.

Divestitures

We completed the sale of the global polyolefin catalyst business to W.R. Grace & Co., based in Columbia, Maryland, on June 30, 2016. The transaction involved technologies, patents, trademarks and the transfer of production plants in Pasadena, Texas, and Tarragona, Spain. These activities had been assigned to the Catalysts division.

On August 26, 2016, we divested our global photoinitiator business to IGM Resins B.V., based in Wallwijk, Netherlands. The transaction comprised technology, patents, trademarks, customer relationships, contracts and inventories as well as the photoinitiator production site in Mortara, Italy. These activities had been organized under the Dispersions & Pigments division. High-performance photoinitiators for electronics customers were not part of the transaction, as the electronics industry is one of BASF’s strategic focus areas.

We sold the Coatings division’s business with industrial coatings to the AkzoNobel Group on December 14, 2016. The transaction included technologies, patents, trademarks, customer relationships and inventories as well as the transfer of two production sites in England and in South Africa.